We’ve all been there. You have a big-ticket item “saved for later” in your online cart, and it’s been there for months. But you don’t have to win the lottery or get an unexpected bonus at work — or go into credit card debt — to make that aspirational purchase a reality.

Thanks to buy now, pay later online installment services, you can divide your purchases into a series of smaller payments (with or without interest, depending on the plan you choose). These installment plans are available at countless online retailers, including Amazon, which offers a “buy now, pay over time” plan with Affirm.

Before you go on a shopping spree, though, you should know the ins and outs of Amazon and Affirm’s payment installment plans. While the “Pay in 4” choice is interest free, monthly payment plans may come at a higher cost. Here’s what to know.

Is There Buy Now, Pay Later on Amazon?

Put simply, yes! Amazon Pay and Affirm allow you to shop now and pay for your purchases over time. If you’ve used Affirm when shopping on other e-commerce sites, you know just how flexible the payment options are. With Amazon specifically, shoppers can choose between the “Pay in 4” option or in monthly installments. The former is interest free, while the latter comes with an APR.

Does Amazon Have a Pay in 4 Option?

Amazon’s “Pay in 4” payment plan with Affirm is what it sounds like — the total cost of your purchase is divided into four payment installments. The four payments are interest free and don’t come with any hidden fees.

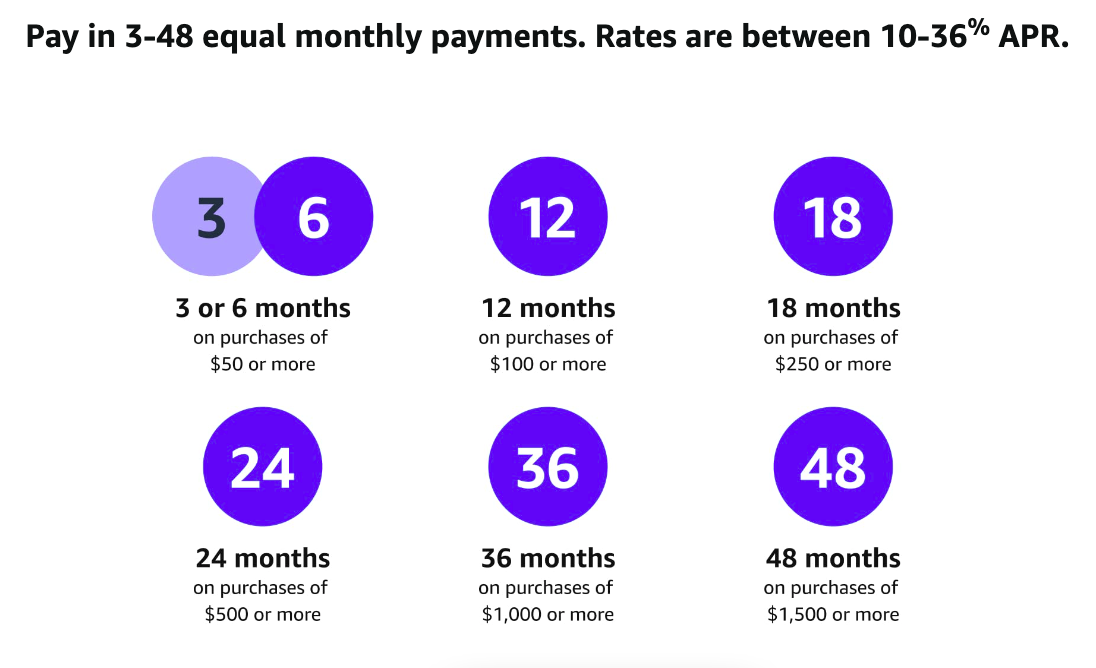

Amazon and Affirm’s monthly option, meanwhile, might be a better choice for large-scale purchases you want to handle with more than four payments. You’ll be given an APR between 10 percent and 36 percent, but you’ll be able to pay it off over a longer period of time.

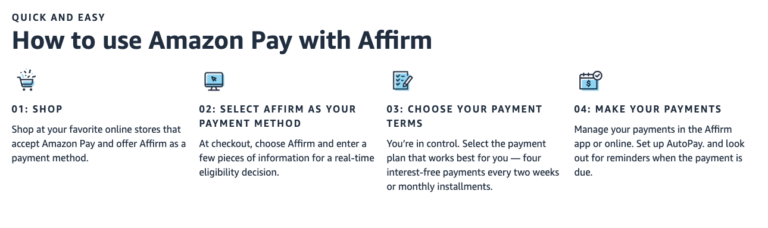

How Do I Add Buy Now, Pay Later on Amazon?

Once you get to the checkout screen, hit “Pay over time with Affirm” instead of just entering your credit card information and placing your order. You’ll need to do an “eligibility check” to determine whether you qualify or (if you’re using the monthly installments option) what your APR will be. But the questions you’ll need to answer are fairly quick and painless. (The eligibility check won’t affect your credit score, so don’t worry there.)

Are There Limits to What You Can Buy with Amazon’s Buy Now, Pay Later Plan?

If you want to divide up the purchase of a singular book or case of toilet paper into super-small payments, you’ll be disappointed. Amazon’s “Pay over time with Affirm” payment option is applicable only to purchases greater than or equal to $50 before tax.

What Items Are Not Eligible for Affirm on Amazon?

While Amazon notes that millions of items are included in the Affirm payment option, not everything is. If you use Amazon to place grocery or prescription medication orders through Amazon Fresh or at Whole Foods, for example, you can’t set up an installation plan for them through Affirm. In addition, Kindle books and other digital purchases, including movies, aren’t eligible for payment plans; neither are Amazon gift cards.

Are There Downsides to Amazon’s Buy Now, Pay Later Installment Plans?

It’s essential to remember that buy now, pay later plans are still loans, and that doesn’t always come with 0% APR. Amazon and Affirm allow customers to choose monthly payment plans up to 48 months long — but those can come at a cost of up to 36% APR. The more you spend, the longer you can stretch out your payment plan; the 48-month option is available only for purchases of at least $1,500. If you want to avoid interest, you’ll need to choose the “Pay in 4 option,” not a monthly payment plan.

Customers also need to remember that the interest rate applied to their Affirm purchase is determined by their credit score, not by Amazon or the specific sellers they’re buying from.

As for that mythical 0% APR offer, though, it’s not for shoppers with exceptional credit scores. Those promotional rates are “available on specific items during limited-time promotions,” Amazon and Affirm note. They may be rare, but interest-free monthly Affirm deals do exist.

And as with other loans, you can pay off your Affirm purchase earlier than the agreed-upon monthly installment plan. You won’t be penalized; you’ll just be paying it off at the same APR as your scheduled payments would have been.

How Do I Find My Installment Payments on Amazon?

If you want to see all of your purchases in one place, click on “Returns & Orders” at the top right corner of Amazon.com. Scroll down in the “Your Orders” list to find the ones that are on installment plans.

How Do I Purchase From Amazon With Afterpay?

Amazon doesn’t offer Afterpay as a payment option; instead, it works with Affirm to offer buy now, pay later plans. Afterpay and Affirm work in similar ways, though — you probably won’t notice a difference in the checkout process.

What About Amazon Layaway?

While Amazon’s “buy now, pay later” partnership with Affirm offers shoppers a way to pay off their purchases over time, it’s separate from the Amazon Layaway program. The layaway system is available only on select items, which are marked with a “Reserve with Layaway” label on the product pages.

The product availability isn’t as extensive as the products you can buy with Affirm; there are also five states where Amazon Layaway isn’t an option. (If you’re in Connecticut, Illinois, Maryland, Ohio, Pennsylvania or Washington, D.C., you’re out of luck here.)

The biggest selling point of Amazon’s layaway program is that there are no fees. Unlike with Affirm’s monthly payment installments, you won’t be paying interest on Amazon Layaway payments, as long as you make your payments on time. The layaway program automatically divides your purchases into five payments; you’ll only have to pay 20 percent of the total cost when you check out. Your credit score also isn’t a factor with Amazon Layaway purchases.

The post How Amazon Buy Now, Pay Later Works: All Your Options appeared first on The Real Deal by RetailMeNot.