Are you ready to jump on your 2022 taxes?? Check out some of the FREE tax filing programs that are available. Doing your own taxes requires a little time and effort, but it’s a great way to save over paying a professional.

If this seems like a daunting task, you can always try to do them yourself and enlist the help of someone else if needed. It’s really a lot easier than it seems. These programs will walk you through step by step.

Keep in mind, it usually costs extra to e-file for your state taxes, but many programs give you the option to print out your return and mail it in for FREE.

For simple taxes, the free software should be enough. Each program will list what is included, but most exclude these items:

- Itemized deductions (Schedule A)

- Business or 1099-MISC income (Schedule C)

- Stock sales (Schedule D)

- Rental property income (Schedule E)

- Credits, deductions and income reported on schedules 1-6, such as the Student Loan Interest Deduction

If you have business expenses and other special forms, it will be necessary to use a more advanced program. Check out your options below.

Quick Comparison Guide

| Turbo Tax | H&R Block | Tax Act | Cash App | FreeTax USA | |

| 1040 EZ | Y | Y | Y | Y | Y |

| Student Loans | Y | Y | N | Y | Y |

| Unemployment | N | Y | Y | Y | Y |

| Retirement Income | N | Y | Y | Y | Y |

| State File | Y | Y | Y | Y | Y |

| HSA Deposit | N | N | N | Y | Y |

| Filing Costs | $0 for Fed & State | $0 for Fed & State | $0 for Fed + $39.95 for state | $0 for Fed & state | $14.99 for state |

| Deluxe Level Cost | $39 + $39 state | $30 + $37 state | $25 + $45 state | $0 for all levels | $0 for all levels + $14.99 state file |

Free Tax Filing Programs

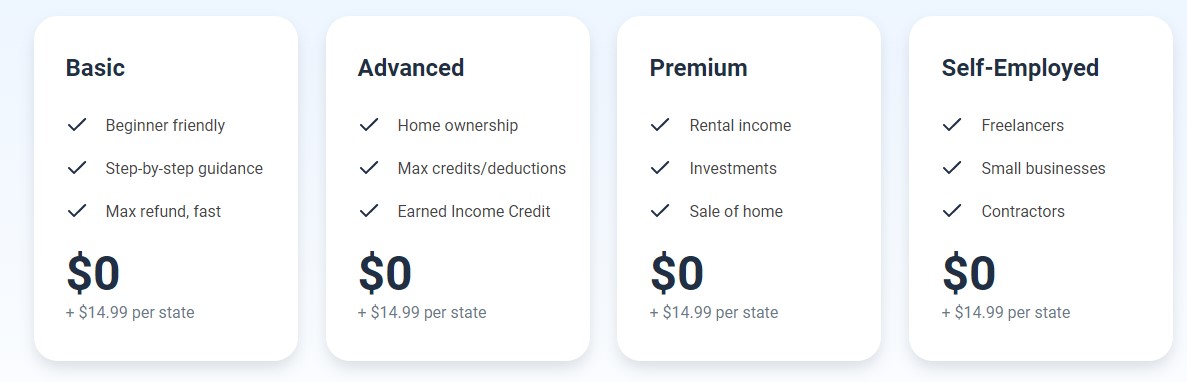

Cash App Taxes

Cash App Taxes (formerly Credit Karma Tax) is a premium product that’s 100% free at ALL filing levels. That includes all of their features, plus free filing for all supported forms and situations. They also 100% guarantee the accuracy of calculations. Plus, if you get audited, they help defend you with free Audit Defense. You’ll also get your refund up to two days faster if you deposit it into Cash App.

This program is the only truly free tax filing program available this year. There are no restrictions. If you have more complicated taxes you may prefer to use Turbo Tax or H&R Block. While CashApp is trustworthy, the interface in the other programs for in depth taxes is a little easier.

No matter what your taxes look like, FreeTaxUSA.com is completely free to file Federal Taxes! Whether you have Simple, Basic, or Advanced situations, everyone pays nothing to file Federal Taxes! Add your state return for $14.99. If you prefer to have peace of mind in case of amendments or audit assistance, you can upgrade to their deluxe version for only $6.99.

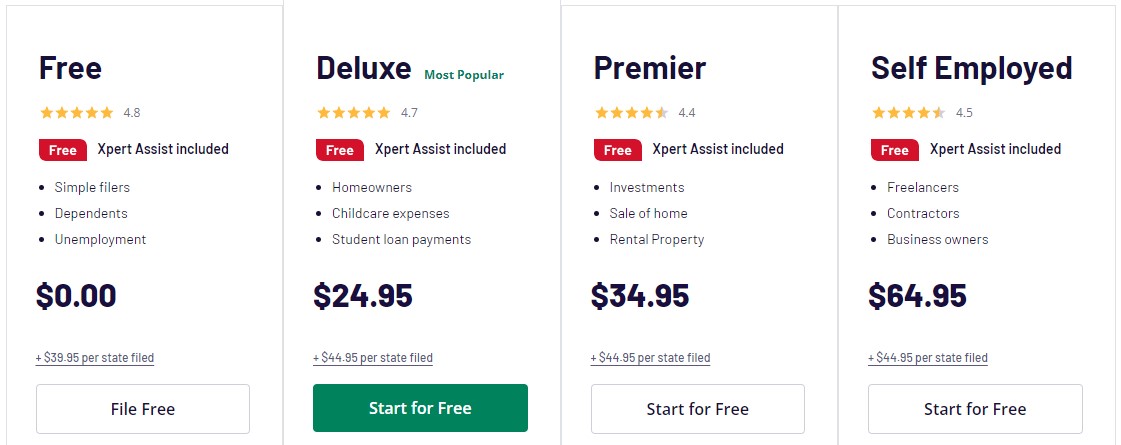

H&R Block Free Edition

H&R Block offers free Federal filing for those with unemployment income, child tax credit, and earned income tax credit (EITC). You’ll need to upgrade if you have a health savings account (HSA), real estate taxes, mortgage interest, or self-employed income.

As long as you don’t have any HSA deposit this year, this is a good choice for free tax filing. Make sure to use their quick buttons to see what you need before starting so you aren’t surprised in the end that it’s not free.

Tax Act

Get a free Federal and State filing from TaxAct. The free version is just for folks with a basic 1040, unemployment income, and dependents. You will, however, pay a hefty price of $39.95 for state filing. This is an easy program to follow with a simple Q&A style format that doesn’t make you feel like you’re learning a different language.

I like their platform and the ease of use, however the state filing price is high. If you have more advanced taxes though, this is a great program and one of the cheapest options for deluxe paid versions.

Turbo Tax Free Edition

To file for free with Turbo Tax, your income tax situation must be very basic. The free version only includes W-2 Income, child tax credits, and EITC. If you have unemployment income or real estate taxes, you will need to upgrade.

This is the most limited free tax filing program on the market and one of the priciest when you find out that you don’t qualify for the free file. I do love their interface, and if you use Quicken, Quickbooks, or Mint you will love that you can auto import your numbers with a push of a button.

Doing your own taxes? Share any tips for beginners in the comments below!

See more online shopping deals.