Few offers strike joy in shoppers more than the two magic words: “cash back.” These special savings seem so clear, easy and straightforward: you spend, and in return, you get some money returned to you. Cash back offers come from retailers, credit card companies and through programs such as the popular cash back plan offered by RetailMeNot, and they can be amazing ways to save while you shop.

But is “cash back” as simple as it sounds? Here’s what to know about different types of cash back offers and how to get the most bucks back for your bucks.

What Does Cash Back Mean?

At its most basic, cash back rewards are ones that have a clear dollar value/merchandise equivalent, rather than “points” that can be used for travel, prizes or other benefits. You spend a certain amount, and then get a percentage returned to you, either to your bank account, into a rewards account or to use with the retailer you spent the money in the first place.

An offer to buy one, get one free is not cash back, even though it saves you money right away. An offer to save 20 percent on the full price of an item is not cash back, neither is spending $100 at a retailer with a credit card and getting 100 “points” to use toward travel or other perks.

Cash back is most commonly associated with credit card companies, but you can also get cash back shopping through RetailMeNot, as well as certain other shopping sites, and cash back rewards directly from retailers, with the fine print being you will need to spend retailer-specific cash with them again and not take it somewhere else.

Cash Back Credit Cards

There are many cash back credit cards out there. Some give you a set amount of cash back that you earn across the board. Others offer a range depending on what kind of purchase you’re making — say 2% cash back on dining, 3% cash back on gas and so on. These popular credit cards typically don’t charge an annual fee, so they are straightforward and simple to use. Some people prefer them over reward credit cards, which give you points to use for future travel or expenses, and which may involve some planning and tracking to use to their best advantage.

As noted above, cash back credit cards may vary the cash back offers. But you can find cash back rewards on popular cards from Chase, Citi and American Express (see current cash back credit cards). In some cases, you’ll need to shop in a certain category to get cash back. For example, one card might offer 3% cash back on groceries, one might offer 2% at restaurants and another might offer 5% cash back on travel purchases. The card will detect the merchant code where you shop, so you’ll automatically get those boosted rewards. Most cards that offer cash back reward you flat 1% back on everything that doesn’t fit its bonus categories.

Getting your earned cash back varies by card — you can usually redeem it into a bank account, get a statement credit for the cash value or even get gift cards. But the bottom line is that you shop, and you get a certain percentage back.

RetailMeNot Cash Back

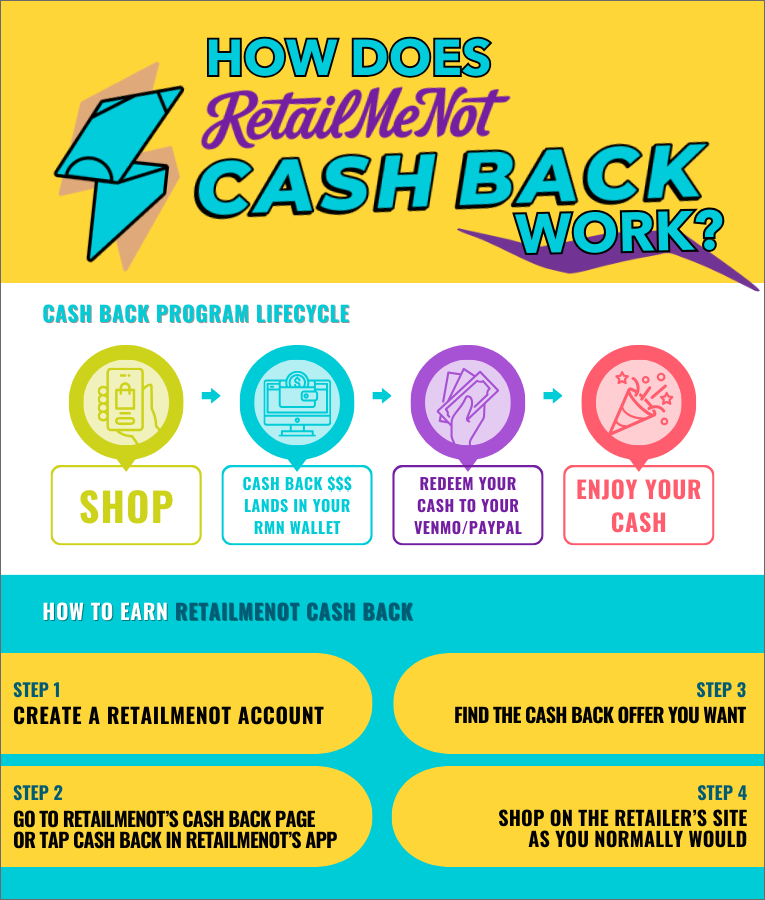

RetailMeNot cash back is a rebate you get after you make an online purchase with any retailer that’s part of RetailMeNot’s program. More than 1,200 retailers participate, from adidas, to Sephora, to Ticketmaster (see them all). Shop with those retailers, and RetailMeNot deposits a percentage back of what you spend in your RetailMeNot wallet. Then you can transfer that balance to PayPal or Venmo, where it becomes real CASH you can use on whatever you like.

To earn RetailMeNot cash back, you have to sign up for a free account with RetailMeNot. Then find the retailer you want to shop from off the cash back page (or tap “cash back” in the app). Once you select the cash back offer you want, you’ll be taken right to the retailer’s site where you shop normally. Your cash back will hit your RetailMeNot wallet in about 45 days.

The amount of cash back varies by retailer, and on RetailMeNot’s annual cash back day, those percentages go up.

Retailer Cash Back Rewards

As you probably know from all the various apps and accounts you have across the internet, just about all retailers, no matter if they are big or small, use loyalty accounts to reward their customers in order to entice them to return again and again, say by giving them points for purchase that can be used toward future savings or other perks. Coupons, deals, sales and other savings are also common.

Cash back from a retailer works a little bit differently than those types of offers. Basically, a retailer’s cash back offer works similarly to a credit card company in that you earn a certain percentage (say, 1 percent) back every time you shop with them. That money is typically credited to your loyalty account and can only be used for future purchases with that retailer (which makes total sense — Target doesn’t want to give you back money just for you to cross the street and spend it at Old Navy!).

Here are some of the most popular retailer cash back programs and how they work:

Target Circle

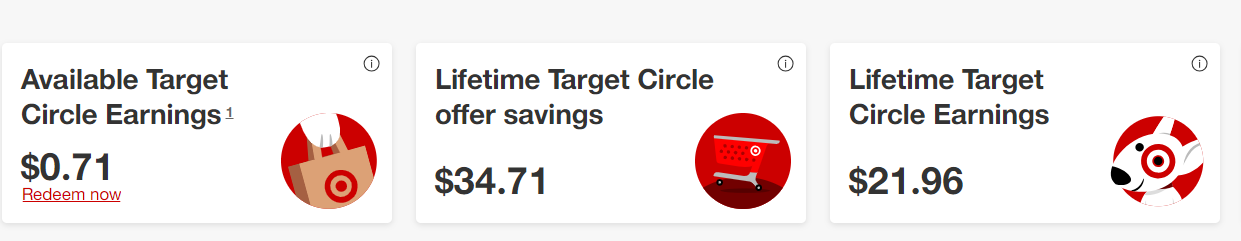

Target Circle is pretty awesome. This free loyalty program from Target gives their members 1% back on all qualifying purchases when shopping at Target. Those rewards can be used on a future Target purchase. At checkout, opt to redeem your rewards, and your final total will be decreased by that amount.

Kohl’s Cash

Throughout the year, Kohl’s runs special Kohl’s Cash promotional events, and if you shop during those times, you earn $10 in Kohl’s Cash for every $50 spent on qualifying purchases, online or in stores. This is available to all shoppers, whether or not you’re a Kohl’s member (though Kohl’s members do get other benefits, so it’s well worth joining their free loyalty program). You can then redeem your Kohl’s Cash during a future predetermined time frame.

Old Navy Super Cash

Savvy Old Navy shoppers are probably familiar with Old Navy Super Cash. Shop during specific Super Cash periods and for every $25 spent, you’ll earn a $10 Super Cash reward to use toward future Old Navy purchases. The maximum amount of Super Cash you can earn per transaction is $30. Your Super Cash can be used toward a future purchase (within a set time frame). And no, you don’t need to have an Old Navy account to earn Old Navy Super Cash.

GapCash

Gap is owned by the same parent company as Old Navy, and their GapCash works similarly to their sister site’s cash back offer. You earn GapCash during certain scheduled periods which you can then spend later on a future Gap purchase. You don’t have to be a Gap cardholder or Gap Good rewards loyalty member to earn GapCash.

Walmart Cash

There have been some changes of late to Walmart’s loyalty program, formerly known as Walmart Rewards, now Walmart Cash. One change is that Walmart+ members can earn Walmart Rewards with purchases of specific grocery items, household essentials and pet care products, which you can apply to a future purchase at Walmart, just like cash.

Unlike the other ways listed above where earning cash back doesn’t cost you anything beyond whatever it is you are purchasing, you do have to be a Walmart+ member to get Walmart Cash. Membership to Walmart+ is $12.95 per month or $98 per year.

The post What Is Cash Back? appeared first on The Real Deal by RetailMeNot.